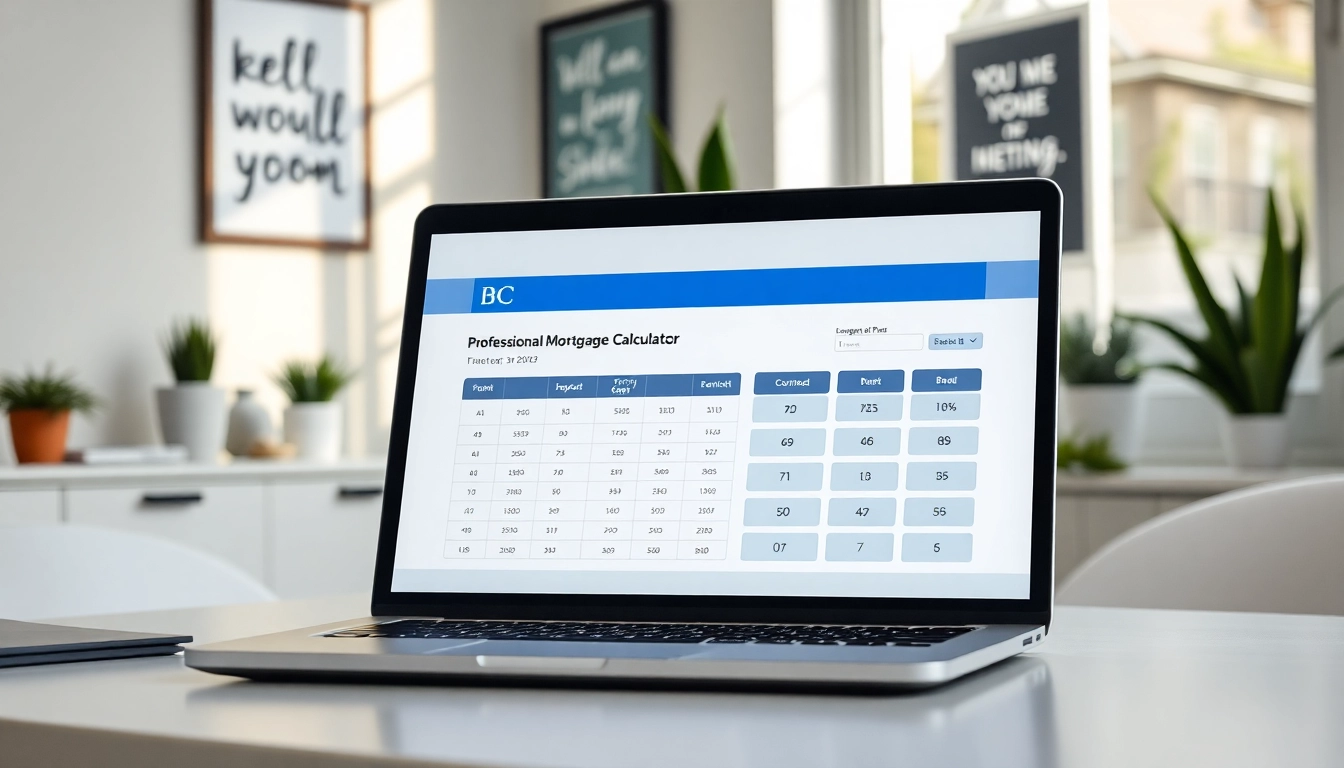

Understanding the BC Mortgage Calculator

Buying a home is a significant milestone for many Canadians, especially those in the beautiful province of British Columbia (BC). However, navigating the complexities of mortgage calculations can be daunting. Utilizing a reliable BC Mortgage Calculator can simplify the process, allowing potential homebuyers to estimate their monthly payments realistically. In this comprehensive guide, we will explore what a mortgage calculator is, the benefits of using one specific to BC, and provide a step-by-step guide to effectively use these tools.

What is a Mortgage Calculator?

A mortgage calculator is a financial tool designed to help prospective homebuyers gauge the amount they may need to pay monthly based on various factors. These factors typically include the loan amount, the interest rate, and the duration of the loan. By inputting specific details, users can obtain quick estimates of their future mortgage payments, aiding them in making informed financial decisions.

Why Use a BC Mortgage Calculator?

The British Columbia real estate market is unique, influenced by region-specific factors such as property values, local government regulations, and varying interest rates. A BC-specific mortgage calculator considers these regional nuances, providing more accurate estimations of monthly payments. This precision is invaluable as it helps potential homeowners budget appropriately and understand the financial commitment they are about to undertake.

How to Access and Use Our Calculator

Accessing a BC Mortgage Calculator is straightforward. Most online real estate platforms and financial institutions offer user-friendly calculators on their sites. Users typically need to enter values such as purchase price, down payment, interest rate, and loan term. Complete the required fields and click the “Calculate” button to receive instant results.

Key Features of the BC Mortgage Calculator

Monthly Payment Estimation

One of the key features of any mortgage calculator is the ability to provide monthly payment estimates. This function allows users to see how different loan amounts and interest rates affect their payments. For example, a borrower considering a home with a purchase price of $600,000 and a 20% down payment would input these figures to get a clear view of what their monthly obligations would look like over a typical 25-year mortgage term.

Interest Rate Considerations

Interest rates play a crucial role in determining mortgage payments. A minor change in the rate can significantly affect the total payment across the loan’s lifetime. The BC Mortgage Calculator allows users to experiment with different rates—ranging from competitive rates offered by various lenders—enabling them to find the best deal available.

Amortization Period Explained

The amortization period, typically spanning from 15 to 30 years, refers to the duration it will take to completely pay off the mortgage. A shorter amortization period means higher monthly payments but less interest paid overall, while a longer period lowers the monthly burden at the cost of increased long-term interest payments. Understanding this balance is crucial for making informed mortgage decisions.

Step-by-Step Guide to Using the Calculator

Inputting Your Financial Information

When using the BC Mortgage Calculator, accurate data input is critical to obtaining reliable results. Here are the necessary parameters:

- Home Purchase Price: The total cost of the home you wish to buy.

- Down Payment: The initial amount paid upfront; typically a percentage of the purchase price.

- Mortgage Term: The length of time over which the mortgage will be repaid.

- Interest Rate: The percentage charged on the loan balance.

Interpreting the Results

Once you’ve input your information and clicked on “Calculate,” the results will include your estimated monthly payment, total interest over the life of the loan, and sometimes a breakdown of principal versus interest payments. It’s essential to review these figures closely to understand longstanding financial obligations.

Adjusting Parameters for Custom Scenarios

The beauty of a mortgage calculator lies in its flexibility. Homebuyers should experiment with different scenarios by adjusting down payment amounts, changing interest rates, or altering amortization periods. This can yield insights into potential monthly payments and help guide homebuying decisions effectively.

Comparing Mortgage Options in BC

Fixed vs. Variable Rate Mortgages

When selecting a mortgage, individuals often face the choice between fixed and variable rates. Fixed-rate mortgages offer stability with constant monthly payments throughout the loan’s life, whereas variable-rate mortgages can fluctuate based on market conditions. The BC Mortgage Calculator can assist potential borrowers in visualizing how these different scenarios impact their payments and help inform their decision-making process.

Understanding Mortgage Terms and Conditions

Each mortgage product comes with specific terms and conditions that can affect repayments. For instance, prepayment penalties, portability options, and other lender-imposed conditions should be considered. Homebuyers are advised to clarify these terms during their mortgage process to avoid surprises later.

Additional Tools for Homebuyers

Beyond the mortgage calculator, homebuyers can benefit from tools such as affordability calculators, which assess how much home they can afford based on income and expenses, or tools that help assess potential monthly costs, including property taxes and home insurance.

Common Mistakes when Using a Mortgage Calculator

Overlooking Additional Costs

One of the most common pitfalls is forgetting to account for additional costs associated with home ownership. These may include property taxes, homeowners’ insurance policies, maintenance costs, and Homeowners Association fees. Including these in your budget calculations is essential for obtaining a realistic financial picture.

Misunderstanding Terminology

Mortgage terminology can be confusing, particularly for first-time buyers. Terms such as amortization, loan-to-value ratio, and principal can create misunderstandings. Take the time to look up definitions and ensure clarity about what each term means and how it affects your calculations.

Failing to Review Different Scenarios

Many users might simply input the first set of numbers that comes to mind and settle for that result. However, exploring various scenarios with different interest rates and down payments can yield significant insights into what monthly payments could realistically look like, helping in preparing for prospective financial commitments.