Understanding Scarper Equipment Loans

In the construction industry, efficiently managing capital is crucial for the success of any project. Acquiring the right equipment, such as scrapers, can significantly impact productivity and operational efficiency. However, the financial implications of purchasing heavy machinery can be daunting for many businesses. One of the most effective ways to facilitate this process is through a Scarper Equipment Loan, which provides businesses the opportunity to acquire necessary machinery without straining their cash flow. This article will delve into the intricacies of scraper equipment loans, their benefits, and strategic insights to maximize their utility.

What is a Scarper Equipment Loan?

A scraper equipment loan is a type of financing specifically designed for businesses looking to purchase scrapers or scraper-related machinery. Scrapers, also known as wheel tractor scrapers, are versatile pieces of earthmoving equipment that are widely used in construction for grading and transporting materials. These loans allow companies to finance the purchase of new or used equipment, enabling them to invest in essential tools that enhance productivity without requiring upfront capital.

How It Works: The Fundamentals of Financing

Scarper equipment loans typically work much like traditional loans. Businesses apply through financial institutions, where lenders evaluate their creditworthiness, financial history, and the value of the equipment being purchased. Once approved, the funds are disbursed, allowing the borrower to complete their purchase. Loan terms can vary significantly, ranging from several months to several years, with interest rates contingent upon the borrower’s financial profile and market conditions.

Benefits of Choosing a Scarper Equipment Loan

There are several compelling reasons why construction businesses should consider securing a scraper equipment loan:

- Preservation of Capital: Instead of tying up cash in a significant purchase, businesses can maintain their liquidity for other operational expenses.

- Tax Advantages: Depending on the jurisdiction, equipment purchases through loans may qualify for tax deductions or benefits.

- Quick Access to Equipment: With financing, businesses can acquire necessary equipment promptly, ensuring projects remain on schedule.

- Predictable Payments: Monthly payment structures allow for better budgeting and forecasting in financial planning.

Evaluating Your Financing Options

Types of Loans for Scarper Equipment

When considering financing for scraper equipment, businesses can choose from a variety of loan types:

- Term Loans: A straightforward loan offering a lump sum upfront, repaid in fixed installments over a set period.

- Equipment Financing: Specifically designed for purchasing equipment, where the machinery itself often serves as collateral.

- Revolving Credit: A flexible credit line that enables borrowing against a predetermined limit, which can be useful for ongoing equipment needs.

- Leasing Options: While technically not a loan, leasing allows businesses to use equipment without purchasing it outright, which may be beneficial for companies that frequently upgrade machinery.

Choosing Between Loans and Leases

Deciding whether to finance through a loan or lease depends on various factors including cash flow, usage plans, and financial stability. Loans are ideal for businesses that plan to keep equipment for long-term projects, as they build equity in the machinery. Conversely, leasing may suit businesses that require the latest technology or equipment for shorter projects, providing flexibility without the obligation of full ownership.

Factors to Consider Before Applying

Before applying for a scraper equipment loan, it’s essential to evaluate several factors:

- Your Business Credit Score: A higher credit score can facilitate better loan terms and lower interest rates.

- The Equipment’s Value: Understanding the market value and depreciation of the scraper will help in negotiating loan terms.

- Loan Terms and Conditions: Carefully review the interest rates, repayment terms, and any hidden fees associated with the loan.

- Budget Implications: Assess how monthly payments will affect your business’s cash flow and overall financial health.

Qualifications for Scarper Equipment Loans

Credit Score Requirements

Like most financing options, securing a scraper equipment loan requires a satisfactory credit score. Generally, lenders look for business credit scores in the range of 600 or above, though better terms can typically be negotiated with higher scores. It is prudent for business owners to check their credit reports for inaccuracies before applying, as corrections can improve financing possibilities.

Documentation Needed for Loan Approval

To expedite the approval process for a scraper equipment loan, businesses should be prepared with the following documents:

- Financial Statements: Recent balance sheets, profit and loss statements, and cash flow reports provide insights into the business’s financial health.

- Tax Returns: Providing tax returns for the past two or three years can help validate income and revenue.

- Business Plan: A well-structured business plan detailing how the equipment will be utilized can enhance credibility and justify loan amounts.

- Buyer’s Agreement: An agreement or bill of sale detailing the equipment being purchased, including its price and condition, can help lenders assess risk.

Understanding Your Business Financials

Having a solid grasp of your business’s financial situation is paramount when seeking financing. Lenders assess several key metrics including cash flow, revenue growth, and overall profitability. Understanding these elements can help present a strong case during the application process, leading to potentially favorable loan terms.

Tips for Securing the Best Loan Rates

How to Improve Your Loan Eligibility

Improving eligibility for a scraper equipment loan can make a substantial difference in both the approval process and the interest rates offered. Steps include:

- Improve Your Credit Score: Pay down existing debts, ensure timely payments, and rectify any errors in credit reports.

- Establish a Solid Business History: A longer history of successful operations can bolster credibility with lenders.

- Increase Your Down Payment: Offering a larger down payment can reduce the lender’s risk and often leads to better rates.

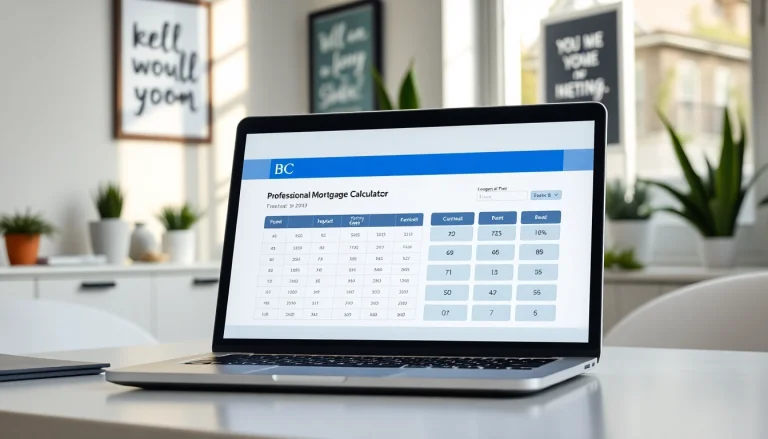

Comparing Offers from Different Lenders

Not all lenders are the same; comparing various offers is a critical step in securing a competitive interest rate. Pay attention not only to the interest rates but also to terms, fees, and prepayment penalties. Utilizing tools like loan calculators can provide a clearer picture of the total cost of different financing options over time.

Negotiating Loan Terms Effectively

Once you have multiple loan offers, don’t shy away from negotiating terms. Approach lenders with your best offer from competing institutions and express your interest in working together to agree on a feasible arrangement. Many lenders are willing to adjust terms or rates to secure a deal, especially if they perceive you as a strong candidate.

Maximizing the Value of Your Scraper Equipment

Maintaining Your Equipment for Longevity

To maximize the ROI from a scraper equipment loan, it’s crucial to maintain the machinery properly. Regular maintenance not only prolongs equipment lifespan but also minimizes costly repairs in the future. Create a scheduled maintenance plan that includes daily inspections, lubrication, and more comprehensive seasonal checks.

Getting the Most Out of Your Scarper Equipment Loan

To effectively utilize a scraper equipment loan, ensure that you are deriving maximum value from the equipment. This involves understanding operational capabilities and ensuring your team is adequately trained. Regular assessments of project needs can also facilitate decisions regarding equipment rental or purchase, optimizing operational efficiency.

Long-term Planning for Equipment Upgrades

Finally, long-term planning is vital when it comes to heavy equipment financing. Establish a timeline for potential upgrades, and regularly revisit your equipment needs based on upcoming projects. This proactive approach can save money, as it allows you to capitalize on equipment depreciation, potential resale values, and favorable financing conditions in the future.